Investing In Pendle Finance (PENDLE) – Everything You Need to Know

Pendle Finance (PENDLE) is a DeFi yield generation ecosystem designed to create more market opportunities for liquidity providers. The network combines an advanced AMM, a unique token structure, and a user-friendly interface to drive adoption. Here”s everything you need to know about Pendle Finance.

İçindekiler

Pendle Finance is a popular DeFi platform. The network leverages a business model that’s similar to bond stripping, where principle and yield remain separate. This structure has helped the network secure $4,364,851,954 Total Value Locked with $17,071,274,249 Total Trading Volume, according to company documentation.

What Problems Does Pendle Finance Attempt to Fix?

Pendle Finance solves a variety of issues that have plagued the blockchain liquidity sector since day one. For one, the network tackles the instability of the markets. Pendle Finance offers fixed-yield liquidity pool options with adjustable periods. This structure enables you to enhance ROIs and avoid volatility.

Source – Pendle Finance (PENDLE)

Lack of Interoperability

Another major concern for DeFi users is cross-chain compatibility. As the DeFi market expands, there’s more demand for interoperability and cross-chain assets. Pendle Finance addresses this issue through its multi-chain approach. Currently, the network supports Ethereum, Arbitrum, BNB, and Optimism.

High Fees

Fees are another roadblock to large-scale Defi adoption that Pendle Finance seeks to eliminate. The platform leverages a PoS (Proof-of-Stake) consensus mechanism and dual fee structure to provide efficient transactions. Low fees help to drive innovation because they enable developers to create more complex dapps.

Benefits of Pendle Finance

Pendle Finance introduces many benefits to community members. For one, the ecosystem includes everything needed to generate passive income and expand your holdings with minimal risk. Additionally, the onboarding process is easy and requires no personal information.

Highly Security

Pendle remains focused on security. The network has completed multiple audits from reputable third parties as part of this strategy. Specifically, Ackee Blockchain and Cmichel completed full system audits.

Developer Friendly Options

Developers can create advanced applications that leverage Pendle Finance features. The network encourages developers to enhance the UX and leverage these tools. There are developed tools that are designed to streamline building on the Pendle Finance Infrastructure.

Versatility

The flexibility provided by Pendle’s multi-token structure enables you to maximize ROI opportunities. This approach supports traders seeking long yields and provides exposure to high-return options.

Passive Rewards

Staking is one of the best ways to secure passive returns. The Pendle Finance staking system differs from the traditional model in multiple ways. For one, you stake PENDLE and receive vePENDLE. This token can be traded, farmed, or used to access network features. This approach ensures liquidity isn’t locked during the staking process, which opens the door to more opportunities.

How Does Pendle Finance Work

Pendle operates as a liquidity pool and yield-generation ecosystem. The protocol allows users to vote on what polls to add using their vePendle tokens. This structure helps drive Pendle token value up by ensuring that a large majority of tokens remain locked in staking protocols, reducing supply.

The Pendle Finance structure leverages week-long periods called epochs. These network snapshots help improve performance by reducing the time needed to confirm the last state of the blockchain.

Redstone Oracles

Redstone oracles are used to track market and token values. Redstone provides decentralized Oracle service over the layer 2 scaling solutions provider Arbitrum’s network. These oracles give the network instant trackability of market conditions, ensuring that liquidity pools remain up to date.

Liquidity Pools

Liquidity pools are large smart contracts that enable users to deposit funds in exchange for rewards. These rewards are based on the amount and time you stake your liquidity. In the Pendle Finance ecosystem, your liquidity doesn’t remain locked in the staking protocol. The use of secondary liquidity tokens allows you to access other options while still securing yield represented as a separate token.

When a user deposits their asset into the Pendle universe, it’s wrapped in the SY token standard. This standard includes an API that allows for cross-chain compatibility. The new asset can then be deposited into the liquidity pool.

Principle Token (PT)

Deposited assets become Principle tokens. These tokens represent the initial amount of token value that remains staked. These assets can be traded, and at the end of the staking period, they unlock the original staked asset.

Yield Token (YT)

Yield tokens are a new concept that encapsulates the potential yield of your staked asset into a token that can be traded or used for other services. This strategy creates a new market where yield tokens can be traded freely on the Pendel Finicne AMM for other digital assets. Notably, YT tokens only exist until the end of their staking period.

Pendle Trade

The Pendle AMM is the core component of the network. It’s where traders meet and exchange digital assets securely. Users can trade both PT and YT tokens on this platform, making it a powerful liquidity aggregator for the ecosystem. Notably, Pendle Trade supports non-custodial wallet transactions.

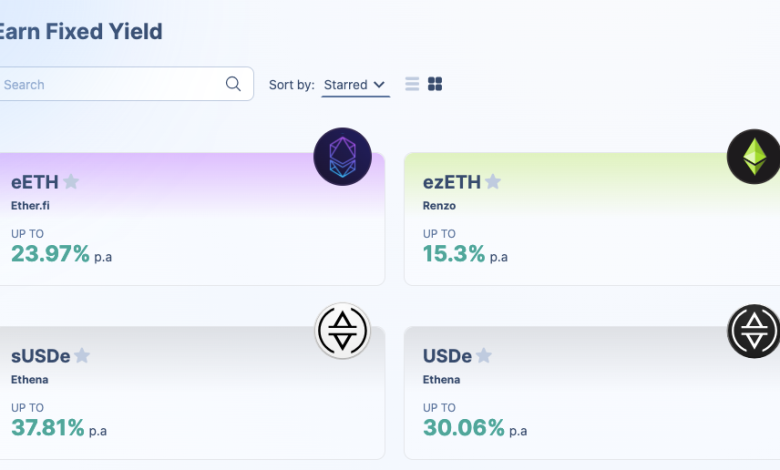

Pendle Earn

The Pendle Earn protocol powers the passive income generation features of the network. These options include both fixed yield and Liquidity Provision systems designed to enable nontechnical users to generate rewards without risk of losing their original assets.

Token (PENDLE)

PENDLE is the main utility token for the Pendle Finance network. Users can stake, trade, and use it to pay network fees, including smart contract executions. When Pendle is staked, vePENDLE is issued. Notably, PENDLE is ERC-20 compliant.

vePENDLE

Staking PENDLE creates vePENDLE, which acts as a liquidity token. This digital asset is designed to decay in value over time, encouraging users to participate in network activities sooner rather than later. You can farm, take, and trade vePENDLE with others. Notably, vePENDLE is an ERC-20 token that lives on the Ethereum blockchain.

How to Buy Pendle Finance (PENDLE)

Currently, Pendle Finance (PENDLE) is available for purchase on the following exchanges.

Uphold – This is one of the top exchanges for United States & UK residents that offers a wide range of cryptocurrencies. Germany & Netherlands are prohibited.

Uphold Disclaimer: Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Binance – Accepts Australia, Singapore, UK, and most of the world. Canadian & USA residents are prohibited. Use Discount Code: EE59L0QP for 10% cashback on all trading fees.

KuCoin – This exchange currently offers cryptocurrency trading of over 300 other popular tokens. It is often the first to offer buying opportunities for new tokens. Restrictions may apply, depending on location.

Pendle – A DeFi Innovation

The Pendle business model takes the tried and true structure of separating yield from principle and tokenizes it to open the door for new earning opportunities. This maneuver makes the platform stand out amongst the competition. As such, it’s a project to watch moving forward.

Learn about more unique blockchain projects now.