As commodity traders boost their bets on an upcoming slump in grain prices, it’s worth checking whether supply gluts could become more commonplace as environmental and geopolitical factors continue to confound markets.

İçindekiler

Along with corn and soybeans, wheat is a soft commodity that’s become more abundant due to a range of factors, and institutions have collectively accumulated a net short position of 546,000 futures contracts across the three crops–representing the biggest negative bet in almost 20 years.

These short positions have flooded in as the result of rising production in key agricultural nations like Brazil, Russia, and the United States. Future production could grow as a result of global warming, making the prospect of an abundant supply of wheat more likely.

“Such a long-running negative trend attracts short sellers,” explained Ole Hansen, head of commodity strategy for Saxo Bank. “As long as the market remains in a downward trend, the short will be maintained and potentially even strengthened.”

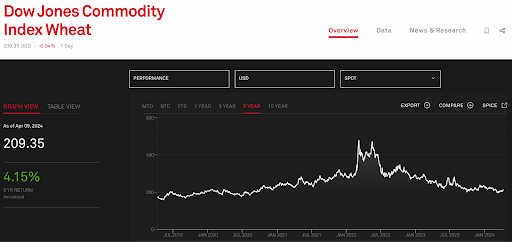

Using the Dow Jones Commodity Index Wheat as an example, we can see that values have undergone a consistent decline following a brief peak in the wake of Russia’s invasion of Ukraine, a leading exporter of wheat. Today, the index sits more than 16% lower than one year ago, with future prospects dwindling.

Mounting bets against some soft commodities have also actively hindered prices for May deliveries, with wheat falling 1.4% to $5.57 ¾ a bushel on the Chicago Board of Trade, while corn and soybeans dipped 1% to $4.31 ¼ a bushel and 0.5% to $11.75 ¼ a bushel respectively.

Could this be a sign of things to come? Or an anomaly that investors can capitalize on? While geopolitics have played a significant role in the performance of crops in the post-pandemic landscape, it may be climate change that has the final say on the price performance of wheat indexes:

Counting the Environmental Impact on Wheat Indexes

While we may be accustomed to associating the environmental impact of global warming with disruption, Ellen Gray of NASA’s Earth Science News Team notes that climate change may actually drive wheat production.

According to a recent NASA study, the environmental impact on soft commodity production could impact the likes of corn and wheat as soon as 2030, with projections suggesting that a 24% decline in maize is likely to take place while wheat may see growth of around 17%.

The study found that the increase in wheat yields will be down to projected increases in temperature, shifts in rainfall patterns, and elevated surface carbon dioxide concentrations from greenhouse gas emissions over the coming years. These fundamental environmental alterations will make it considerably more challenging to grow maize in tropical climates but could enable more nations to expand their wheat production.

“We did not expect to see such a fundamental shift, as compared to crop yield projections from the previous generation of climate and crop models conducted in 2014,” noted lead author Jonas Jägermeyr, crop modeler and climate scientist at NASA’s Goddard Institute for Space Studies (GISS).

However, the University of Leeds’ Priestley Centre for Climate Futures notes that climate change can also bring widespread disruption to the quality of wheat production even as conditions become more favorable overall for growth.

Because wheat, like all plants, is genetically predisposed to flower at strategic times depending on its local environmental conditions, more unpredictable weather patterns could hinder the quality of crops and impact global inventories.

While growing wheat production could see prices fall, greater risks of crop disruption can improve scarcity and drive the value of wheat higher.

Of course, it’s important to note that climate change will bring widespread disruption to many soft commodity markets over the coming years, so institutions must remain switched on to the wider impacts surrounding crop production.

Geopolitics as a Major Disuptor

Recent years have also seen major disruptions in wheat prices caused by geopolitical tensions. In fact, wheat has often reacted quickly to escalations in the conflict between Russia and Ukraine.

Because both nations are key agricultural regions, their ability to grow wheat has carried a significant impact on indexes.

For instance, the news of an attack on a Ukrainian port on the Danube River in July 2023 saw a sharp rise in wheat prices, with wheat futures on the Chicago Board of Trade jumped 8.5% to $7.57 a bushel at the time.

However, prices fell lower the following September when news broke of strong crops in Russia sought to replace Ukraine’s impacted supply.

Geopolitics has made an impact on wheat prices from beyond the conflict in Ukraine, and in April 2024, China sought to disrupt global wheat prices by canceling a series of shipments from the United States in a perceived bid to secure better prices and boost its own food security.

Trading in Uncertainty

For investors seeking to find opportunities amid wheat volatility, it’s important to remain cautious and receptive to possible changes to the index prices from a variety of sources.

With this in mind, it may be advantageous to seek security by utilizing exchange-traded funds focusing on soft commodities. This can help institutions to manage risk more effectively while finding a healthy level of exposure to global production.

“UCITS-compliant ETFs are experiencing increased interest among hedge fund managers and institutional investors, driven by their adaptable structures and investor-centric advantages,” highlights Andrew Bradshaw, Global Head of Prime – Hedge Funds at 26 Degrees Global Markets.

“Investors benefit from enhanced liquidity, rigorous risk management, and regulatory approval for cross-border distribution,” Bradshaw added. “This growth reflects a strategic alignment with retail investors’ preferences, offering hedge funds an avenue to diversify their product offerings while maintaining transparency and regulatory compliance.”

Although the wheat market is likely to struggle to build momentum as production improves due to climate change, the gloomy outlook could be offset by a series of short-term volatility owing to many different contributing factors.

While opportunities could become more tricky to identify, institutions can find plenty of upside if they can remain in tune with the ecosystem’s key contributing factors.